It’s often said that breakfast is the most important meal of the day, and C-stores are increasingly becoming the go-to destinations for consumers looking to fuel their busy days. The convenience factor aligns perfectly with the fast-paced lifestyles of modern consumers, offering a seamless solution for those who need a quick and satisfying breakfast on the go. With a growing emphasis on quality and variety, the right product mix can help C-stores not just meet but exceed expectations and become the ultimate morning stop.

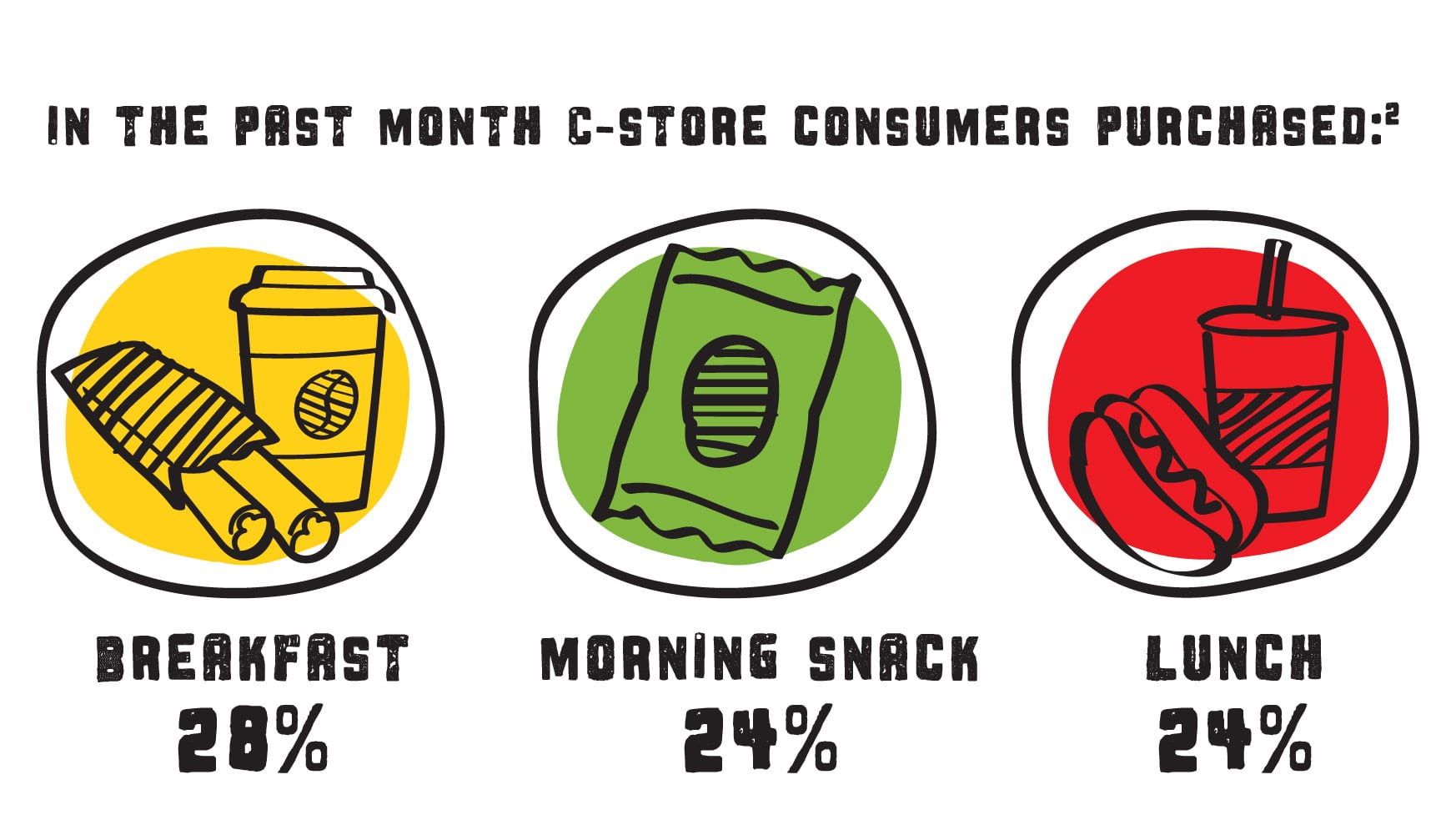

Sales trends in C-stores paint a picture of the growing importance of breakfast. The morning snack occasion has shown noticeable growth (+4%),1 indicating a shift in consumer habits. As the demand for morning options rises, it’s the perfect time for operators to cater to this burgeoning market.

What Consumers Are Looking For

What motivates people to choose C-stores for their breakfast needs? Speed and variety are definitely at the forefront.

Unlike QSRs or coffee chains, where elaborate coffee or sandwiches may cause delays, C-stores offer a quick and efficient solution. High quality coffee has the ability to drive traffic into C-stores during the morning daypart, and consumers can grab a hot breakfast burrito or taquito without compromising their busy schedules.

Quality coffee draws consumers away from coffee cafes and fast food and INTO C-stores.3

C-stores can compete and capture breakfast share of stomach with a high-quality coffee program — and elevating their hot prepared breakfast food items can help keep those consumers coming back. As the perception of C-store coffee bars improves, there are valuable opportunities for combo deals tied to morning drinks and hot case or roller grill items.

While some customers have their go-to standards, many others like to switch up their choices or go with what strikes their mood on any given day. C-stores are viewed as offering more variety than quick-serve restaurants, and 61% of consumers indicate variety is their top reason for shopping at them.4 Making sure you have a balance of hot, fresh, sweet, and savory food options ensures you have something for everyone.

“Whether it’s an enhancement to their hot beverage or hot foods program, many C-store retailers are addressing breakfast daypart gaps and figuring out ways to take advantage of profitable grab ‘n go opportunities in the morning.”

— Sandra Deas Ray, Vice-President, Foodservice Business Unit Sales & Marketing, Ruiz Foodservice

Promoting Breakfast

Having the right breakfast mix is only one part of the equation; getting the word out is also crucial. There are a few key areas to consider when marketing your choices.

SOCIAL MEDIA

Timing your posts for mornings and evenings puts you top of mind when people are on their morning commute.

AT THE PUMP

This is a key area to inform those who might not be planning a trip inside about all your breakfast choices and deals.

WITH YOUR LOYALTY PROGRAM

Either through eBlasts or in-app notifications, letting your loyalty customers know about new or upcoming offerings can pay off big.

TRADITIONAL MEDIA

Radio and out-of-home advertising still reach big audiences. They can be costly, but if you’re going all-in on breakfast, it’s worth the spend.

Filling the Gap

Ruiz Foodservice understands that a strong innovation pipeline is critical across all dayparts, and the AM occaion is a current area of focus given the importance to C-store retailers. Be on the lookout for the launch of two premium bulk breakfast burrito SKUs to help operators elevate their offerings.

Plus, with morning burritos and empanadas from El Monterey®, America’s #1 brand of frozen Mexican food,5 as well as deliciously bold breakfast Tornados®, Ruiz Foodservice can help you round out your morning menus.

Be sure to reach out with any questions about unlocking even more breakfast potential.

1 Circana CREST® US, 3ME Dec 2023

2 “Translating Menu Trends” Webinar, Technomic 2023

3 Technomic C-Store Foodservice Update and Outlook, Spring 2023

4 Ruiz Foods Proprietary Consumer Attitude & Usage Study, 2023

5 IRI POS Data ending 9/10/23